WARNING: This comparison rate applies only to the example or examples given. Different rates apply for different loan amounts and may depend on the duration of a fixed rate period or the ratio of the loan amount to the property value.

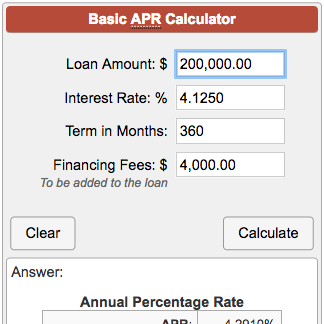

It’s calculated using a standard formula that includes the interest rate, as well as certain fees and charges relating to a loan (not all fees and charges are included).Ĭomparison rate is calculated on the statutory assumption of $150,000 loan over 25 years but the minimum required loan amount is $200,000 for the Complete Home Loan Package. It’s a tool that can help you identify the truer cost of a loan. Loans for a property to live in (also known as owner-occupier loans) include – but aren’t limited to – loans to fund the purchase of a property or refinance an existing loan, where the borrower currently resides or intends to reside in the property. Loans for an investment purpose (also known as investor loans) include – but aren’t limited to – loans where the predominant part of the loan is used to invest in shares, land, construction or an established dwelling (including refinance of investment loans). Contact us today to start the mortgage pre-approval process.What’s the difference between a property to live in, and an investment purpose? At Spire Financial, we will help tailor your loan options to be meet your financial goals and our loan experts are here to guide you through the home purchase or refinance process. Establishing a strategy for your additional payments and then sticking to it is more important than the timing. Putting any extra cash towards your payments, especially in the beginning, will push you further along the amortization schedule and shorten the life of your loan. Consistency is Key Whether you choose to pay a little more each month or make one yearly lump payment, consistency will bring more success. The best way to make additional payments on your mortgage is the way that makes the most sense to you and your financial goals. In this case, you may prefer to use bonuses or other “extra” income as a yearly lump sum payment. However, it may not be in your best financial interest to tie up additional monthly income on a regular basis. If you choose to pay extra on your monthly payment, you are paying a little more principal and a little less interest than you did on the previous payment, meaning you could pay off the loan slightly faster in the long run. Should I Pay Extra Monthly or Yearly? While any extra payment towards your mortgage will push you farther along your loan amortization schedule, the two main options are to either put more money towards your monthly mortgage payment or to make yearly lump sum payments.

0 kommentar(er)

0 kommentar(er)